CA Home Insurance Is On Life Support

CA is feeling a bit blue these days when it comes to insurance. The insurance market is definitely under the weather. At my office last week, I said to my team that the insurance market is on life support. While State Farm made headlines a couple weeks ago for pausing new business, there are a lot of other insurance companies, who have already paused new business or slowed it WAYYYYYYYyyyyyyyy down in the last several months or year.

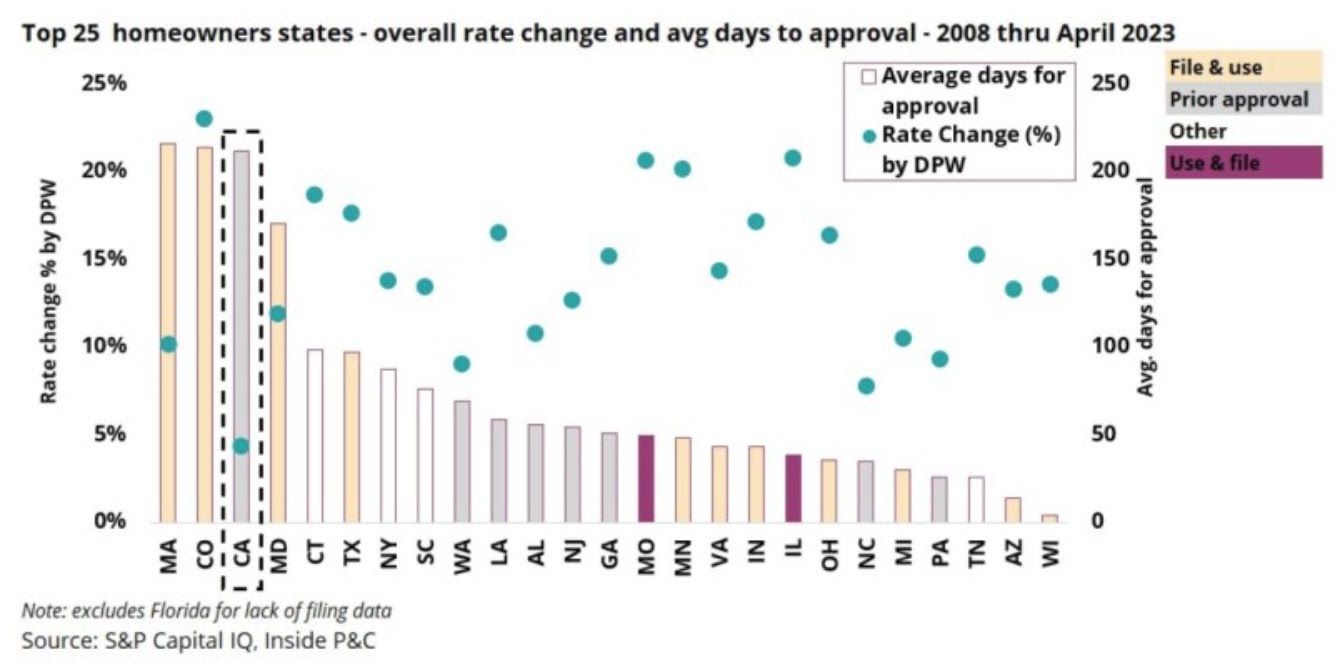

As I wrote a few months ago in late February/early March, we knew there was going to be a bumpy road ahead. Insurance is a private industry and they would like to make a small profit. What has happened in California is they are in fact doing the opposite. They are losing money. The insurance companies have been filing for rate increases with the Department of Insurance (in order to remain a sustainable business and to try to get back to being at least slightly profitable, which allows them to pay claims to their policy holders, as needed). Unfortunately, the rate reviews can take 6 months or longer and there is no promise of a rate change once the Department of Insurance has reviewed everything.

In fact, historically speaking, according to Inside P&C (in the chart shown below), CA ranks as one of the longest to get rates approved and they have had the lowest success in increasing rates over the last 15 years. (Florida is not included in their data.)

As the news headlines continue to shed some light on the insurance market, our advice is simple; please be patient and sit tight, as the rates are going to increase for everyone. We know having any increase in your cost of insurance is bad. Unfortunately, it is or will be happening to everyone. With so few insurance companies accepting new clients today, the risk is not being spread as much as it used to be, even just one year ago. Insurance companies do not want a monopoly on the market. The insurance business model is about spreading risk to avoid disaster. Plus, the insurance companies, who are still open for new business, are losing money on every new policy they start today.

We are always here for you and please let us know if you have any questions. We will help you navigate this crazy market as best as we can, now and for years to come.

Elizabeth's Corner

My wife, Elizabeth, is a Mom, an amazing wife and an incredible chef. She trained at the California Culinary Academy in San Francisco. She shares a helpful tip below.

With summer here, you may want a lighter dish in between the summer BBQs. Here is a great recipe for Balsamic Chicken Lettuce Wraps. This recipe is courtesy of Kristin Maxwell.

Balsamic Chicken Lettuce Wraps

Ingredients:

Grilled Balsamic Chicken

- 2 lbs boneless, skinless chicken breasts

- 1/2 cup balsamic vinegar

- 1/2 cup orange juice

- 1/2 cup olive oil

- 4 tbs honey

- 1 tbs dried basil

- Salt and pepper to taste

Balsamic Glaze

- 1/2 cup balsamic vinegar

Lettuce Wrap

- 8-12 Whole Lettuce Leaves Butter, Iceberg or Romaine

- 1 pint strawberries, sliced

- 1/2 cup pecans

- 1/2 cup Feta Cheese

Directions:

- Mix marinade ingredients, except chicken, in a medium bowl.

- Rinse chicken and pat dry. For even cooking, pound chicken to a uniform thickness, about a half inch or so. Season uncooked chicken breasts with salt and pepper and place in a large Ziploc bag. Pour marinade over chicken, press out air much air as possible, seal and place in the fridge for at least 30 minutes.

- Remove chicken from the bag and discard the remaining marinade. Cook chicken on a preheated grill over medium heat until no longer pink; about 3-4 minutes per side, depending on thickness. Set aside and cover loosely with foil to rest for a few minutes.

- While the chicken is cooking, prepare the balsamic glaze. Pour about 1/2 cup balsamic vinegar into a small saucepan and cook over medium low heat until reduced by half. Sauce should be thick enough to lightly coat the back of a metal spoon. Set aside.

- To prepare the lettuce wraps, gently peel leaves, wash and pat dry. Chop chicken and layer in the lettuce leaves, followed by sliced strawberries, pecans and Feta Cheese. Top with balsamic glaze.

- Serve immediately.

Enjoy!

Aaron Rosen

Arc 23 Insurance

Services

Auto/Home/Life, Umbrella,

Earthquake/Flood, Commercial,

Workers'Comp,

Professional Liability,

Cyber

License # 0L56377

Good Quote:

"Most people give up just when they are about to achieve success. They quit on the one-yard line. They give up at the last minute of the game, one foot from a winning touchdown."

- H. Ross Perot

Companies We Represent

Nationwide

Foremost

Travelers

Bamboo

Guard

CSE

Hippo

Safeco

Stillwater

NatGen Premier

And many more...

Inspirational Quote:

"We're here for a reason. I believe that reason is to throw little torches out to lead people through the dark."

- Whoopi Goldberg

Trusted Partners

Roofing Company

Mike Duby, Beach Cities Roofing

949-697-6561

Remediation Company

Brian Byers, EHS

949-734-9046

Repiping Your Home

Repipe1

866-737-4731

Health Insurance

Mike Primicerio

949-633-3988

Personal Injury Attorney

Eric Traut

714-835-7000

Estate Planning Attorney

William London

949-474-0940

Auto Body

Rae or Max,

South County Auto Body

949-859-7990

Until next time, if you have questions, concerns, or need some advice, please call our office 949-484-7500.